1. A smart contract that programmatically dictates how the DAO functions (analogous to a corporate structure and process, but this one is all code, no people)

2. A collection of DAO token holders who are pseudo-anonymous users who own a stake in the DAO (you can think of them as shareholders with voting rights)

3. The DAO has financial holdings by way of an Ethereum coin bank. The coins held by the DAO are valued at roughly 110 million USD at the time of writing, but have prior topped out around 200 million USD. (This is analogous to the bank account of a corporation)

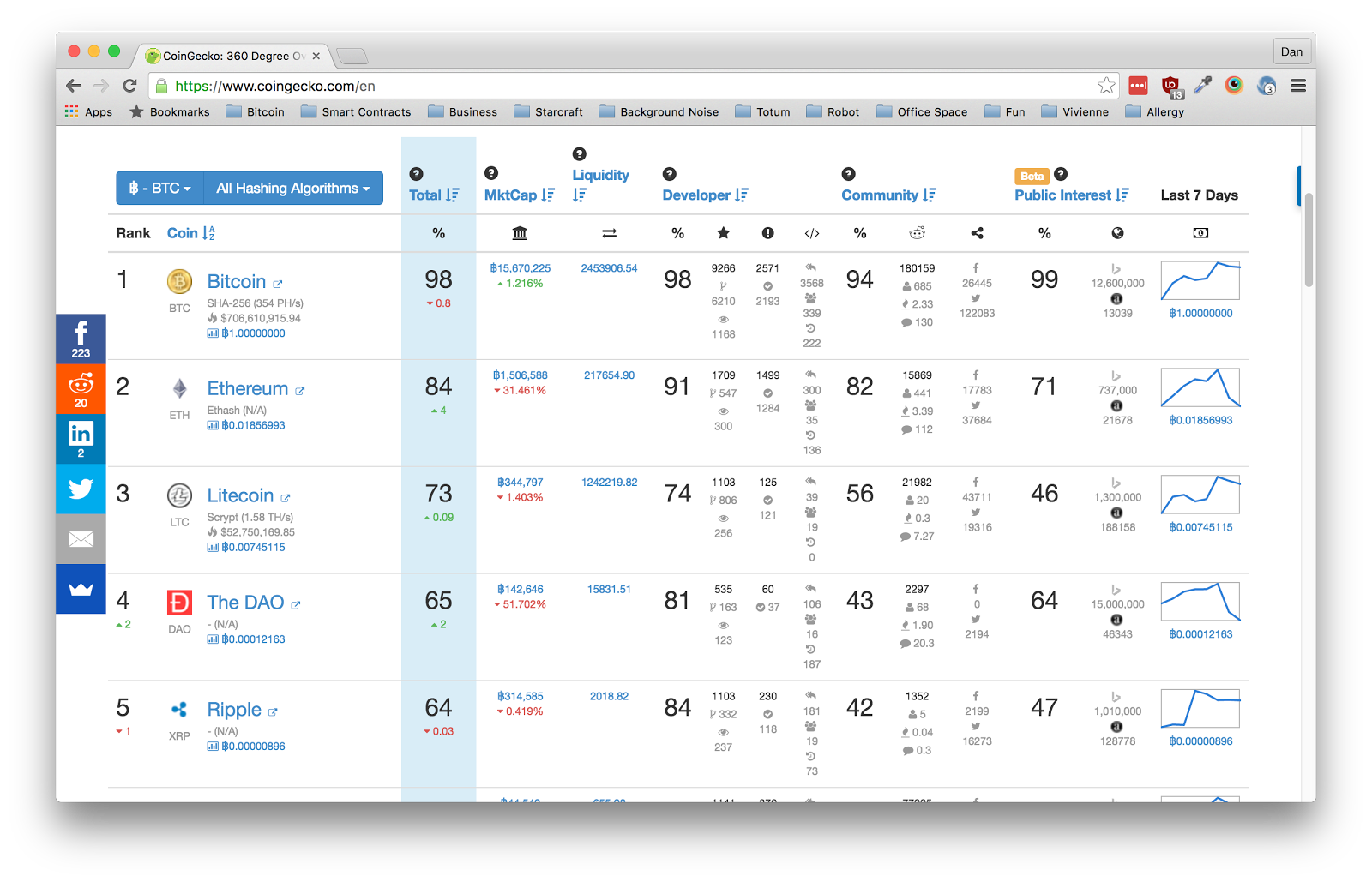

Ethereum is currently the second most valuable cryptocurrency blockchain in the world behind only Bitcoin. Market Cap is roughly 1.5 Billion at the time of writing.

There are several significant things worth mentioning about the DAO with this in mind.

1. The DAO is a first of its kind experiment.

2. Close to 10% of the entire Ethereum cryptocurrency market cap is currently invested in the DAO.

3. As mentioned before, the DAO has no employees. It only has token holders. Those token holders have the right to vote on anything that is put up for referendum and they get voting power in accordance with how many tokens they hold. This is very similar to normal stock proxy voting, except the proposals that are being voted on in the DAO are written by anyone who wishes to propose a way to spend the DAO's Ethereum digital cash reserves.

This brings us to yesterday when a token holder exploited a flaw in the DAO code and was able to drain roughly 60 million USD out of the DAO Ethereum bank account.

Once the theft was discovered in the hours that followed some of the prominent Ethereum and DAO developers began to formulate a plan. That plan was to fork Ethereum to freeze the stolen coins and then eventually fork again to send replacement coins back to the DAO. In order to do that they would need to convince the miners (a decentralized group of people) to accept the new code. They are currently in the process of attempting to do that.

In a follow-up post I will cover my thoughts on what this DAO failure means for Ethereum and the future of smart contracts.